Regional Express Holdings

As a general rule, I stay away from investing in the aviation sector given its tough and volatile business conditions. But on rare occasions like this one, I bend the rules. Regional Express is Australia’s largest regional airline based in Mascot, NSW. It was formed by merging the old Hazelton and Kendell businesses, which was sold by the administrators of Ansett in 2001.

Here are 4 key reasons why I like Rex:

- Sole operator in a substantial number of routes it services – monopoly.

- Secured key landing slots at Sydney airport – competitive advantage.

- Good conservative management whose interest is aligned to the other shareholders as majority shareholder is also the executive chairman.

- Currently cheap, low debt levels and running a share buyback program.

RPT routes

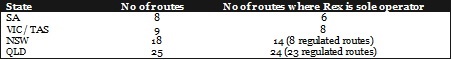

Whilst Rex offers charter services, the bulk of its revenue (approximately 80%) comes from regular passenger transportation (RPT); which will be the focus of this analysis. Rex is the sole operator on a very high number of RPT routes it services; as shown in table below:

In terms of regulated/ licensed routes, nearly all of the Rex’s routes in Queensland are regulated whereas slightly more than half of its New South Wales routes are regulated. Notwithstanding the regulated routes, Rex is still the sole operator of many competitive routes in South Australia, Victoria and New South Wales.

Given that these routes are competitive, it begs the question why haven’t Rex’s main competitor (Qantaslink) stepped into the ring?

The answer lies in the type of aircraft and the annual route patronage of these rural communities. Rex operates a uniform fleet of Saab 340s, a 36 seater turbo prop aircraft which was mostly purchased off lease for approximately $2 million each whereas Qantaslink operates a variety of aircraft with the 74 seater, $30 million Bombadier Dash 8-Q400 making up the largest portion of the fleet. Given the low annual patronage of some of these smaller routes (sub 50,000p.a) and the competitive pricing by Rex, the economics simply isn’t attractive enough for a company the size of Qantas. In NSW, I’ve observed that Qantaslink stays away from unregulated routes where the annual patronage is less than 100,000.

Rex has in excess of 540 weekly slots at Sydney airport of which approximately 45% are for peak periods between 7.30am to 9.00am and 5.30pm to 7.00pm. Rex is the largest holder of NSW regional slots at Sydney airport. These slots are vital for regional carriers trying to get passengers in and out during peak hours at Sydney airport. Without primetime slot ownership, it makes it extremely difficult for a new entrant to compete in New South Wales due to the high volume of business travellers on regional routes. This slot system is currently only practised in Sydney airport to alleviate congestion.

Financials

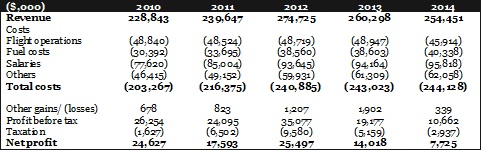

Summary of the income statement over the past 5 fiscal years is as follows:

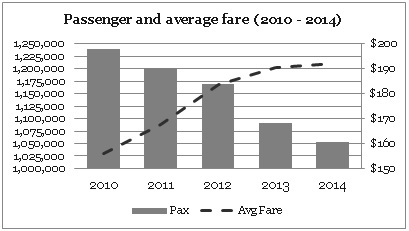

Revenue has increased by 11% over the past 5 years in spite of an overall decrease of 15% in passengers over the same period. This has been achieved to a large extent by fare increases, average fares have increased from $155.90 (2010) to $192.10 (2014), as shown in the chart below.

Costs on the other hand have jumped by 20% over the same period. The main driver of increased cost is salaries and wages (which also happen to be the largest expense item). The enterprise bargaining agreements (EBAs) currently in place allows for a 2% real growth in wages. As a result of revenue not keeping up with costs, net profit has decreased.

A summary of its financial position at the end of fiscal year 2014 and half year 2015 is as follows:

The majority of asset value lies in the PPE, specifically aircraft, rotable assets and buildings. Rex operates a total of 96 aircraft, most of which are owned outright. Based on its annual report, carrying value for its aircraft and other rotable assets is $214.5 million (FY2014). A high level sense check below suggests that the risk of a material overstatement of the PPE is low.

The other thing I would like to point out on the balance sheet is a liability called “unearned revenue”. In reality this is not a really a liability as it is fares paid in advance (common in the airline industry) which are not likely to be refunded. Although the accounting standards deem this a liability, it is actually more like an asset as the company can earn interest on this float. Therefore, the net asset on the balance sheet is somewhat understated.

Valuation

The market capitalisation of Rex is approximately $107 million.

Based on FY2014 results, it is currently trading on a price earnings multiple of 13.8x ($107m/$7.7m) and a net tangible asset multiple of 0.57x ($189m/$107m). This appears to suggest that the company is cheap when looking through the asset lens but not as cheap when looking through an earnings lens. This is simply because Rex is currently not earning an adequate return on its capital.

The return on equity (ROE) based on the book value of equity (FY2014) is 4% ($7.7m/ $189.1m). As a result, the market has discounted the value of equity (market capitalisation) so that a purchaser buying in at the current share price would get a more reasonable ROE or yield of 7.2% ($7.7m/ $107m).

Generally speaking low growth companies have historically been priced on yields of 8% – 10% (price earnings ratio of 10x – 12x). Based on this general rule, this suggests that the market is pricing in only marginal growth for Rex. The airline industry is a cyclical business and Rex’s passenger numbers have been falling since the GFC. The drop in passenger numbers have slowed in FY2014 and at some future point in time will eventually reverse. Given its high operational leverage (mostly fixed costs), any turnaround (increase in revenue) would mostly flow down to the bottom line.

Given the above, I believe the LTM price earnings ratio of 13.8x is undemanding as:

- Management has disclosed that the decrease in oil price will lead to a $2mil savings for FY2015. Although I am unable to predict with any degree of certainty that oil prices will stay low, some media reports have reported that the world currently has surplus oil production.

- In FY2015, Rex bagged the Queensland Western 1,2 and Gulf routes greatly increasing its exposure to the Queensland market. This win should help slow down or reverse the drop in passengers.

- The reintroduction of the enroute rebate scheme. Although this scheme is less generous than its predecessor, it is certainly better than nothing.

- Savings from leasing charges as Rex currently owns all of the Saab 340s. These savings will kick in when the current bank loans are all fully repaid.

Given the cyclicality of its earnings, it is difficult to predict what earnings will be next year. However, the combination of the above factors has created a “tail wind” behind earnings in FY2015. Whilst there is of course a possibility of earnings deteriorating further in FY2015, I think there is a higher chance of them being better than FY2014 given this “tail wind”. Moreover the HY2015 earnings were better than the corresponding HY2014 earnings.

In the long run, I believe Rex will be able to earn an adequate return on equity given its monopoly position on most of its routes. Therefore, the book value of its assets should provide an indication of its intrinsic value (based on the replication method). Its net tangible book value (HY2015) suggests an intrinsic value of $184.6 million. Compared to the market capitalisation, it implies a margin of safety of 42%, which is pretty good.

Risks

An investment in Rex is of course not without any risks. In my mind the potential downside risk for an investment in Rex are:

- Rex’s fares have reached a point where any further increase will result in a greater fall in passenger numbers, in which case it would be challenging for revenue to keep pace with growth in costs.

- Regional councils spending to upgrade their airports and passing on cost increases to passengers which will further increase fares and lower passenger numbers.

- Government implementing more stringent new safety or security guidelines which may lead to increase costs for regional airlines.

- In the longer term, the Saab 340s will eventually need to be replaced (in 10 – 15 years time) and large capital expenditure will be required.

Overall, I believe the market has already priced in some of these risks (market believes there will be little or no growth) and that passengers are falling mainly due to a pull back in business and government spending. So I believe an investment in Rex at current levels (around $1 a share) has limited downside risk but a greater upside potential. However, this upside will probably take some time to materialise given the downward trend in passenger numbers; but if you wait for conditions to improve then as Buffet says “if you wait for the Robins, spring will be over”.